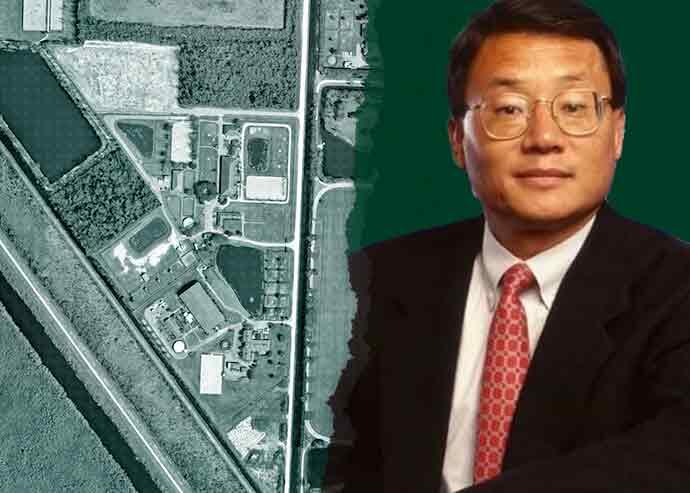

Lou Pai Wiki, Height, Age, Family, Wife, Net Worth and Career

Luo Pai is a business person from China and America who became well-known as a previous manager at Enron

Luo Pai is a business person from China and America who became well-known as a previous manager at Enron Corporation. The very large energy company became known for its failure in 2001 because of a huge problem with how they kept their financial records.

While working at Enron, Luo Pai was in charge as the top executive of two smaller parts of the company Enron Energy Services and Enron Xcelerator, which was Enron’s section for new business investments. His time in these Enron roles happened at the same time as the company’s big problems and when people discovered the financial cheating that caused Enron to go out of business.

Lou remains one of the most enigmatic figures from the Enron scandal a man who managed to walk away with hundreds of millions while his former colleagues faced prison sentences. Known as “the invisible CEO,” Pai’s story involves corporate intrigue, personal scandal, and perfect timing that allowed him to cash out before one of history’s biggest corporate collapses.

Lou Pai Net Worth

Lou Pai net worth is estimated at $270 million making him one of the few Enron executives to maintain substantial wealth after the company’s collapse. His fortune stems primarily from his strategic stock sales before Enron’s bankruptcy, when he cashed out approximately $353 million worth of company shares.

Pai’s wealth accumulation wasn’t just from salary he earned millions through stock options and bonuses during his tenure as CEO of Enron Energy Services and Enron Xcelerator. Even after paying $31.5 million in legal settlements, including $30 million in restitution to shareholders and $1.5 million in fines, Pai retained the majority of his fortune.

His post-Enron investments in real estate have also contributed to his net worth. The former executive purchased the massive 77,500-acre Taylor Ranch in Colorado for $23 million in 1999, then sold it for $60 million in 2004 a $37 million profit that demonstrated his business acumen extended beyond energy trading.

Who is Lou Pai?

Lou Pai is a Chinese-American businessman and former Enron executive best known for his role in one of corporate America’s biggest scandals. Born Lou Lung Pai (白露龍) in Nanjing, China, he became a central figure at Enron during the company’s meteoric rise and spectacular fall.

Pai earned the nickname “the invisible CEO” due to his preference for staying out of the public eye, rarely giving interviews or making public appearances. This low profile served him well when Enron collapsed, as he had already departed the company and cashed out his holdings months before the scandal broke.

Unlike other Enron executives who faced lengthy prison sentences, Pai managed to avoid criminal charges, though he did settle civil charges with the Securities and Exchange Commission. His ability to exit Enron at the peak of its stock price while avoiding the legal consequences that befell his colleagues made him a subject of intense scrutiny and speculation.

How Did Lou Pai Become Famous?

Lou Pai became famous as one of the key executives at Enron who managed to escape the company’s collapse with his wealth intact. His fame stems not from his corporate achievements, but from the circumstances surrounding his departure from Enron in June 2001 just months before the company filed for bankruptcy.

Pai’s notoriety increased due to the personal scandal that precipitated his exit. His frequent visits to Houston strip clubs led to an affair with Melanie Fewell, a relationship that caused his divorce from his first wife, Lanna. The financial settlement from this divorce reportedly forced Pai to sell his Enron stock holdings, which inadvertently saved him from the massive losses other executives experienced.

The media attention intensified when investigators discovered Pai had sold 338,897 shares and exercised options for another 572,818 shares between May and June 2001, at an average price of $53.78 per share. This timing—just months before Enron’s stock became worthless made him a symbol of corporate insiders who profited while shareholders lost everything.

Where is Lou Pai Now?

Lou Pai continues to maintain a low profile, living with his wife Melanie in Wellington, Florida. While he has engaged in several business ventures since leaving Enron, his primary focus appears to be on his family and their shared passion for equestrian sports.

His story remains a compelling chapter of the Enron saga, highlighting how timing, luck, and a costly divorce allowed one executive to escape the full consequences of one of history’s most notorious corporate collapses.

Lou Pai Wikipedia and Biography

Lou Lung Pai was born on June 23, 1947, in Nanjing, China, and immigrated to the United States at age two with his family. His father, Shih-I Pai, was an aeronautics professor who took a teaching position at Cornell University, providing young Lou with an academic environment that fostered his mathematical talents.

Pai demonstrated exceptional mathematical abilities from an early age, earning recognition as a math prodigy. He pursued higher education at the University of Maryland, College Park, where he obtained both Bachelor’s and Master’s degrees in economics. His academic success opened doors to government service, where he began his career in the federal sector.

Before joining Enron, Pai worked for the Securities and Exchange Commission (SEC) from the mid-1970s through 1986. This experience in financial regulation would later prove invaluable during his corporate career, giving him deep insights into securities law and market operations that few business executives possessed.

Lou Pai Age

Lou Pai is currently 78 years old, having been born in 1947. His zodiac sign is Cancer, and he holds Chinese-American nationality. As someone of Chinese ethnicity, Pai represents the success that many Asian-American professionals achieved in corporate America during the 1980s and 1990s.

Lou Pai Early Life and Education

Lou Pai early life was shaped by his family immigration experience and his father academic career. Coming to America as a toddler, Pai grew up in an environment that valued education and intellectual achievement. His father’s position at Cornell University exposed him to academic excellence from an early age.

Pai’s mathematical talents emerged during his school years, earning him recognition as a prodigy in the subject. This aptitude for numbers and analytical thinking would later serve him well in the complex world of energy trading and financial engineering that characterized Enron’s business model.

His education at the University of Maryland provided him with a strong foundation in economics, giving him both theoretical knowledge and practical skills in market analysis. The combination of his mathematical abilities and economic training made him particularly well-suited for the quantitative aspects of energy commodities trading.

After completing his education, Pai chose government service over private sector employment, joining the federal workforce before moving to the SEC. This decade-long experience in financial regulation gave him unique insights that would prove invaluable during his later corporate career.

Lou Pai Personal Life

Lou Pai personal life became intertwined with his professional downfall in ways that ultimately saved his financial future. His marriage to Lanna Lee in 1976 produced two children, but the relationship deteriorated during his high-stress years at Enron.

Pai’s frequent visits to Houston strip clubs during his time as an Enron executive led to his affair with Melanie Fewell, a relationship that would change both their lives dramatically. When Pai divorced Lanna in 2000 to marry Melanie in 2001, the financial settlement required him to liquidate a substantial portion of his Enron holdings.

His current marriage to Melanie Fewell Pai has produced three children: Kyle Pai, Christopher Pai, and Natalie Pai. The couple operates Canaan Ranch, which specializes in horse sales, acquisition, and racing. Their shared interest in dressage, an Olympic equestrian sport, has become a significant part of their post-Enron life.

The family maintains residences in multiple states, including a 21-acre equestrian estate in Wellington, Florida, and ranches in Texas and Virginia. Their lifestyle reflects Pai’s substantial wealth and his ability to maintain his fortune despite the Enron scandal.

Lou Pai Parents and Family

Lou Lung Pai (白露龍) was born in Nanjing, China, in 1946. His family moved to the United States when he was two years old after his father, Shih-I Pai, accepted a teaching position at Cornell University. The family eventually settled in Maryland in 1953, where his father became an aeronautics professor at the University of Maryland, College Park.

Pai earned both his bachelor and master’s degrees in economics from the University of Maryland. His sister, Sue Pai Yang, later became the first Asian-American appointed as a Worker’s Compensation judge in New Jersey.

Lou Pai Marriages

Lou Pai personal life has been a significant source of public interest, marked by two marriages and a high-profile affair

Lou Pai Wife, Melanie Fewell Pai

Lou Pai married to Lanna, Lou began an affair with Melanie Fewell, a married exotic dancer. The affair resulted in a pregnancy, and their child was born in April 1997. After his divorce from Lanna was finalized, Lou married Melanie Fewell, who is now known as Melanie Pai.

Melanie was born in Houston, Texas, in 1962 and studied management and finance at The University of Tulsa. An entrepreneur in her own right, she founded Canaan Ranch in 1999, a business focused on horse sales and racing.

Together, Lou and Melanie Pai have been deeply involved in the equestrian sport of dressage. They have raised three children: Kyle Pai, Christopher Pai, and Natalie Pai. Their daughter Natalie is married and has a child of her own.

Lou Pai Ex-Wife, Lanna Lee

In 1976, Lou Pai married his first wife, Lanna Lee. The couple was together for over two decades and had two children. Their marriage ended in a widely publicized divorce after Lanna discovered Pai’s affair and the child he fathered outside their marriage.

The financial settlement of their divorce required Pai to liquidate a substantial portion of his Enron stock, a move that inadvertently saved him from financial ruin when the company later imploded.

Lou Pai Career/Professional Journey

Luo Pai a businessman of Chinese and American heritage, became well-known because he was linked to Enron, the energy firm that fell apart because of a huge accounting problem in the early 2000s. Pai started working at Enron in 1987 and quickly moved up, eventually becoming the CEO of Enron Energy Services (EES), a part of the company that helped it grow a lot in the 1990s.

Being connected to Enron is clearly the most important thing about Pai’s work life. As the leader of EES, he was very important in helping Enron grow and plan its strategies. However, he left the company in 2001, only a few months before Enron crashed, which made people wonder and guess if he knew about the company’s growing money problems.

It’s said that Pai sold a lot of Enron shares before the company failed, which let him get a large amount of money from the situation. This timing and his money gains just made his leaving even more controversial. Even though people were suspicious of him, Pai was never officially accused of doing anything illegal in the Enron scandal.

He used his right to stay silent during the court cases that were filed against the company by a group of people. Because of the court case, Pai had to give up $6 million that Enron’s insurance was supposed to pay him as a company leader, and that money was instead put into a fund for Enron’s shareholders.

Since Enron fell apart, Pai has mostly stayed out of the public eye, seeming happy to keep a low profile after the scandal that became the most important part of his work life. The time he left and the money he made have always connected him to one of the most famous business scandals in American history.

Lou Pai Enron

In 1987, Pai left the SEC and joined Enron, where he became a key lieutenant to CEO Jeffrey Skilling. Known for his introverted and reclusive nature at the office, he was nonetheless a central figure in the company’s aggressive growth strategy.

In March 1997, Skilling appointed Pai as the CEO of Enron Energy Services (EES), a subsidiary focused on selling energy contracts to corporations and homeowners. Despite his quiet demeanor, Pai became a symbol of Enron’s culture of excess.

He was known for using the company jet for personal travel and expensing lavish lunches. In May 2001, just months before Enron’s collapse, Pai abruptly resigned from his position at EES.

Cashing in on Enron Stock

Pai’s departure from Enron was accompanied by a massive sale of his company stock. Between May 18 and June 7, 2001, he sold hundreds of thousands of shares. In total, before the company’s bankruptcy, he cashed in an estimated $250 million to $353 million from Enron stock, not including his salary.

This incredible timing allowed him to walk away with a fortune while thousands of other employees lost their jobs and retirement savings.

Life After Enron

While many Enron executives faced jail time, Lou was never criminally charged. He exercised his Fifth Amendment rights during the Enron class action lawsuits and avoided a trial.

In July 2008, he settled civil insider trading charges with the SEC. The out-of-court settlement involved a $30 million restitution payment and a $1.5 million fine. He was also barred from serving as an officer or director of a public company for five years.

Since leaving Enron, Pai has been involved in several business ventures. He was a founder and former chairman of Element Markets, a renewable-energy consulting firm, and later became a partner at Midstream Capital Partners LLC.

Lou Pai Colorado Ranch

Pai became the second-largest landowner in Colorado. In 1999, he purchased the 77,500-acre Taylor Ranch for $23 million, which included the 14,047-foot Culebra Peak. He sold the property in 2004 for a reported $60 million.

He and his wife, Melanie, have focused on their equestrian business, Canaan Ranch. In May 2022, they purchased a 21-acre equestrian estate in Wellington, Florida, for $8 million, cementing their presence in the elite horse-racing community.

Business Ventures

Pai pursued various business interests. He was a founder and former chairman of Element Markets, a consulting firm focused on renewable energy and pollution emissions credits. He later became a partner at Midstream Capital Partners LLC.

More recently, reports have suggested that Pai has been helping his former boss, Jeffrey Skilling, re-enter the energy sector by connecting him with investors for a digital platform focused on oil and gas projects.

Did Lou Pai Go to Jail?

Lou Pai never served jail time. This outcome surprised many observers, given the harsh sentences handed down to other Enron executives like Jeffrey Skilling and Kenneth Lay.

Several factors contributed to Pai’s ability to avoid criminal charges:

Timing of His Departure: Pai left Enron in May 2001, several months before the company’s bankruptcy filing in December. This separation created some legal distance between him and the worst of Enron’s accounting manipulations.

Fifth Amendment Protection: When Enron class action lawsuits were filed, Pai exercised his Fifth Amendment rights against self-incrimination, refusing to testify in ways that might have exposed him to criminal liability.

Cooperation and Settlement: Rather than fight charges in court, Pai chose to settle. In July 2008, he agreed to pay $31.5 million to resolve insider trading allegations $30 million in restitution to shareholders and $1.5 million in civil fines.

Focus on Civil Rather Than Criminal Penalties: Prosecutors focused their criminal cases on executives who remained at Enron through its collapse and who were more directly involved in the fraudulent accounting schemes.

As part of his settlement, Pai was barred from serving as an officer or director of any public company for five years, a prohibition that expired in 2013.

Lou Pai Story

Lou Pai journey offers several important insights about corporate responsibility, personal relationships, and financial timing. His ability to avoid criminal prosecution while other Enron executives faced lengthy prison sentences demonstrates how legal outcomes can depend on timing, cooperation, and the specific nature of one’s involvement in corporate wrongdoing.

The role of his personal life particularly his affair and subsequent divorce in forcing him to sell Enron stock at the optimal time adds an almost theatrical element to his story. What began as a personal crisis became his financial salvation.

His post-Enron reinvention through Element Markets and ranch operations shows how business leaders can rebuild after scandal, though it required staying largely out of the public eye and accepting significant legal restrictions on his corporate activities.

Lou story remains a fascinating chapter in the Enron saga, illustrating how individual choices, timing, and legal strategy can dramatically affect outcomes even within the same corporate disaster. While he escaped the criminal justice system, his legacy remains forever intertwined with one of America’s greatest business failures.

Social Media Presence

Lou pai social media activity he operates ranches in Texas and Virginia called Canaan Ranch with his wife Melanie Pai, whom he married in 2001.

The couple has become involved in equestrian sports, particularly the Olympic discipline of dressage. In May 2022, they purchased an $8 million, 21-acre equestrian estate in Wellington, Florida, further cementing their commitment to the horse world.

This lifestyle represents a stark contrast to Pai’s high-pressure corporate days at Enron. The ranch operations and equestrian focus suggest a desire for privacy and a more grounded way of life away from the scrutiny of financial markets and regulatory oversight

Frequently Asked Questions

Who is Lou Pai?

Lou Pai is a Chinese-American businessman and former Enron executive. He was the CEO of Enron Energy Services (EES) and known as “the invisible CEO.” He famously sold hundreds of millions of dollars in Enron stock just months before the company’s collapse in 2001.

Who is Lou Pai wife?

Lou Pai is married to Melanie Fewell Pai. They married after his divorce from his first wife, Lanna Lee. Melanie is an entrepreneur and an accomplished figure in the equestrian world.

How did Lou Pai avoid jail time?

Lou Pai sold his Enron stock to fund a divorce settlement months before the company’s financial problems were made public. Because his sell-off occurred so early, prosecutors did not charge him with insider trading like other Enron executives. He did, however, settle civil charges with the SEC.

What is Lou Pai net worth?

Lou Pai net worth vary, but he walked away from Enron with over $250 million. His current net worth is estimated to be around $270 million.

What happened to Lou after Enron?

After leaving Enron, Pai founded Element Markets and became a partner in Midstream Capital Partners LLC. He was barred from serving as an officer or director of public companies for five years (until 2013) as part of his SEC settlement.

Did Lou Pai go to prison for Enron?

No, Lou Pai never faced criminal charges related to Enron. He settled civil charges with the SEC but avoided the prison sentences that other Enron executives received.

How much money did Lou Pai make from Enron?

Pai cashed out approximately $353 million worth of Enron stock before the company’s collapse, though he later paid $31.5 million in legal settlements.

Where does Lou Pai live now?

Pai currently resides in Wellington, Florida, on a 21-acre equestrian estate. He and his wife also operate ranches in Texas and Virginia.

![Thunderbolts (2025) [Hindi 5.1-DD & English] Dual Audio 480p 720p 1080p [Full Movie] https://www.biographygen.com/wp-content/uploads/2026/01/ThunderboltsThe-New-Avengers.png](https://www.biographygen.com/wp-content/uploads/2026/01/ThunderboltsThe-New-Avengers.png)